I'm at the Royal Society this morning for the 2 day programme on "How does ecological risk related to commercial risk?", and am reporting on the morning session. The full program is being livestreamed so please do dial in if the below notes seem interesting to you. I put this note up almost live, so any errors below are my own. (Update: partial day 2 notes now available below)

1 Opening Keynote by Sir Partha Dasgupta

The summit kicked off with a keynote by economist Sir Partha Dasgupta. The focus was on the intersection of nature and economics, covering how markets fail to account for the ecosystems that sustain them. His landmark report covered ecosystem services, freshwater, tipping points, and physical risk, bringing to light the urgent need to reframe economic activities around the services provided by nature.

He began by distinguishing between two types of market activities:

- Provisioning goods. Commodities like food, water, timber, fibres and so forth are the primary products which, when aggregated and valued at market prices, form the GDP (the visible outputs) of human endeavour.

- Processes are the background work of maintaining and regulating services which produce these goods are problematic from a commercial perspective. The services aren't extractive in the same way as provisioning goods, but they express themselves via the goods.

In the language of economics, there is a missing link here for the markets of processes, which makes for inefficiency, but more alarmingly a crisis in the management of natural resources. The action is on the activities we undertake which affect our landscape -- and the huge number of species affected therein. Our knowledge is extremely limited, but keeping them intact is in our interest.

There is a good deal of work on option values which economists have tried to uncover, but research has somewhat stalled in recent years. The risks that companies face as a consequence of this inefficiency are correlated, which is extremely dangerous for market stability.

He tried to address this in the review of the Economics of Biodiversity report, but it needs a lot more thinking. A feature of the human condition is that fragmented ecosystems lose their productivity. The sum of the productivity of an ecosystem vs the sum of the individual parts has a big difference. The late Tom Lovejoy did a lot of work on this in the context of the Amazon rainforest ecosystem. Similarly, we are looking at a fragmented nature ecosystem today in a global context as more and more habitats get truncated.

The background extinction rates of organisms are hugely growing - the option value of organisms suggests we are losing enormous amounts of value in the form of unknown lifeforms. The correlation risk here is something that whole governments need to take on board -- it's too vast for any single organisation to take on board!

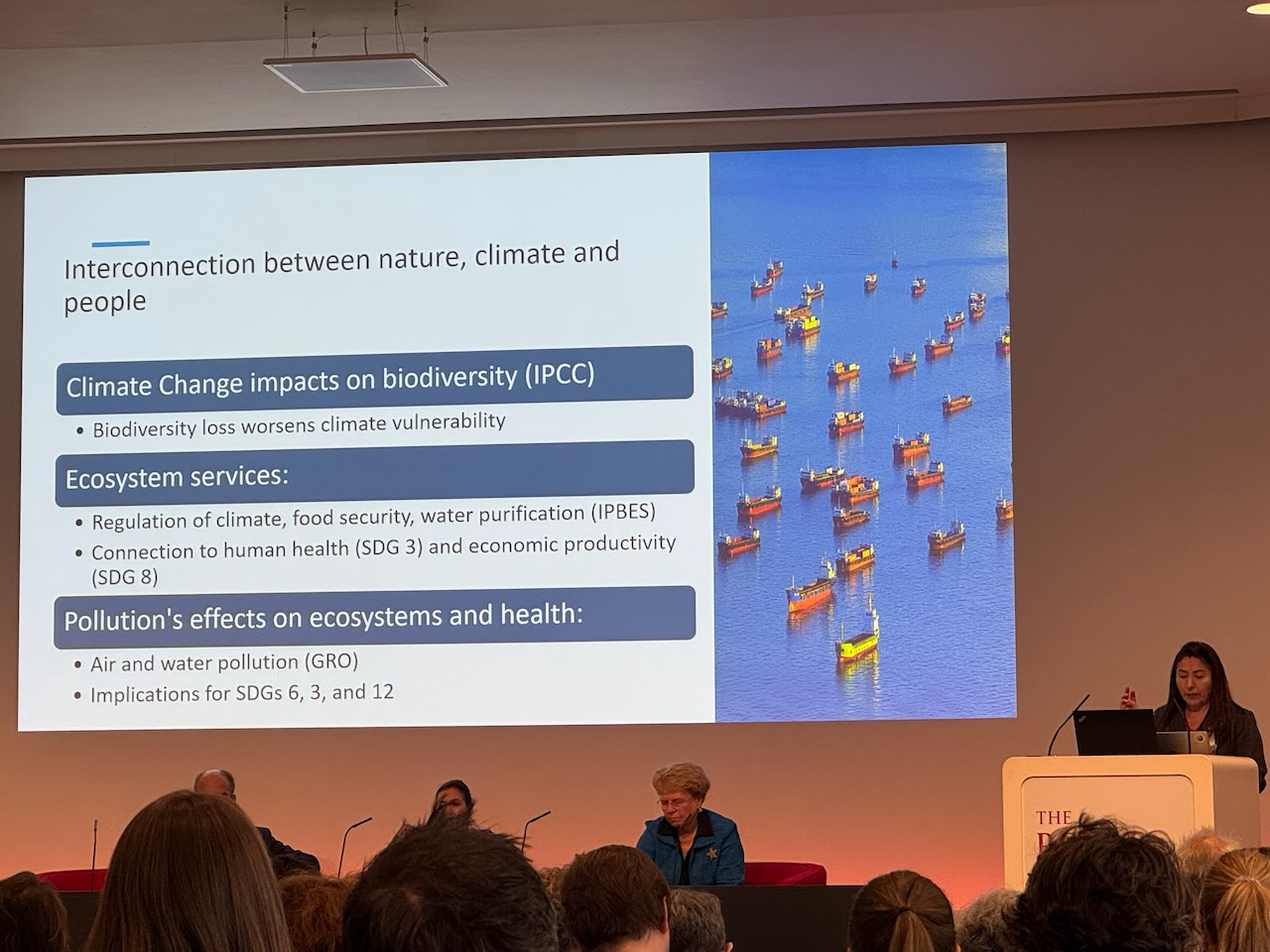

2 Ecosystem Services and Physical Risk

Jane Lutchenko chaired the panel session. She is the administrator of the NOAA, "on loan" to the White House to work on nature and technology policy.

2.1 Dr Tony Juniper CBE

We have not always been looking at nature through a financial perspective. The journey of Natural England in the 1940 began more an ethical and moral perspective, and the scientific and beauty value of landscapes. It's only recently been that practical impacts of nature and its benefit to humanity is being considered.

The Millenium Ecosystem Assessment commissioned in 2001 by Kofi Annan was a stocktake of the earth's natural capital assets, and remarkable for how it made it clear how if we didn't reverse the decline of nature then we would be unable to meet humanity's needs such as ending poverty. A few years later in 2007 the G8 commissioned "Economics of Ecosystems and Biodiversity" that worked until 2011 and helped reset the understanding of the human world and is fundamental to how we conduct our ecosystem. Later on the "Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services" (IPBES) commissioned by the UN general assembly to consider the contribution of nature to people.

So as nature rises in the political eye, there are multiple national programs all trying to assess the state of natural assets. In 2020 there was a Treasury organisation to bring natural capital into national accounting in the UK. Dasgputa's landmark report established that nature and the economy are intertwined, which was a huge change in thinking. We no longer need to assume that degradation of nature is the price of progress, and the new reality are that the range of ecosystem services are critical to how we need to conduct our ecosystem services into the future. Pollination, carbon capture, biomimicry, nutrient capture, when all added up are worth more than the UK's GDP, but we still struggle to how to measure this as part of our conventional economies!

After 20 years of expert studies and carefully constructed datasets, we still struggle to do the right thing, but why? No one company is quite able to fully embrace the scope of the problem. There are 1000s of medium to large companies that depend on agriculture, but they are all dependent on 25 billion tons of water moving around intercontinental distances for the global water cycle. Any particular one company might make a small difference to reduce their deforestation footprint but without collective action they will be unable to make a global change. There must be a collective force to bring things together, and also better understanding of the connectivity across these factors.

However, there still isn't a prominent intellectual place for the connections between ecology and economy and still isn't being taught in undergraduate courses and so not making it through to high political decision making. There is still a lot of emphasis on financial growth, but not much discussion of nature: we should be factoring in that nature is the mechanism by which we can achieve financial growth. It's quite hard to meaure biodiversity vs "tons of carbon". Environment regulation must move from stopping harm, but also plot pathways to nature recovery. So the link between ecological and commercial risk is very real and must be measured and actioned.

2.2 Freshwater (Professor Louise Heathwaite CBE FRS)

Her first ever "proper job" was working at the Nature Conservancy as their first hydrologist. Freshwater is at the centre of the triple planetary crisis today. As a result of these challenges, what we see is an intensification of the water cycle:

- increasing temperatures increase atmospheric water holding capacity

- increases preciptation, increases evaporation, so the cycle intensifies

- evaporative demand increases and so extreme drough events increase

Our lack of investment in proper waste recycling infrastructures is now coming back to haunt us. They impact hugely on freshwater availability and quality. It disrupts commercial supply chains, and the quality of the supply for both water and ecosystem services for which we heavily depend.

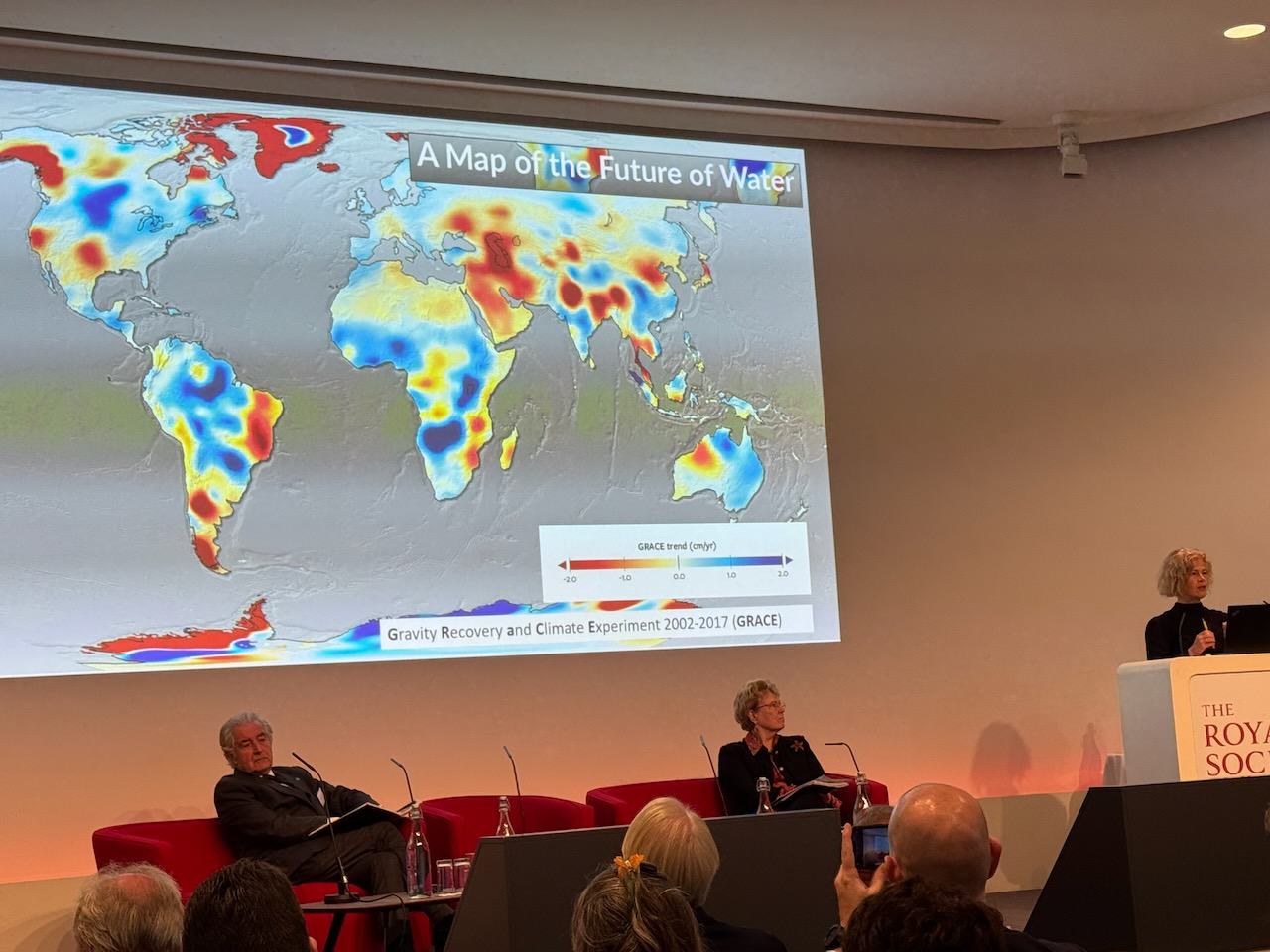

Two satellites (GRACE) spinning around earth from 2002-2017 that can detect changes at a centimetre scale of changes in water mass. The image shows how connected the world is, and the scale of the changes at the poles and greenland is incredible. Some research just finished up in Greenland, and the rate of warming in the arctic is roughly 2x the global warming rate. Greenland is losing almost 260 gigatons of ice per year, which is a million Olympic-sized swimming pools a year -- an awful lot of water to move around into the ocean systems. The ocean cycles aren't on the slide, but they will impact.

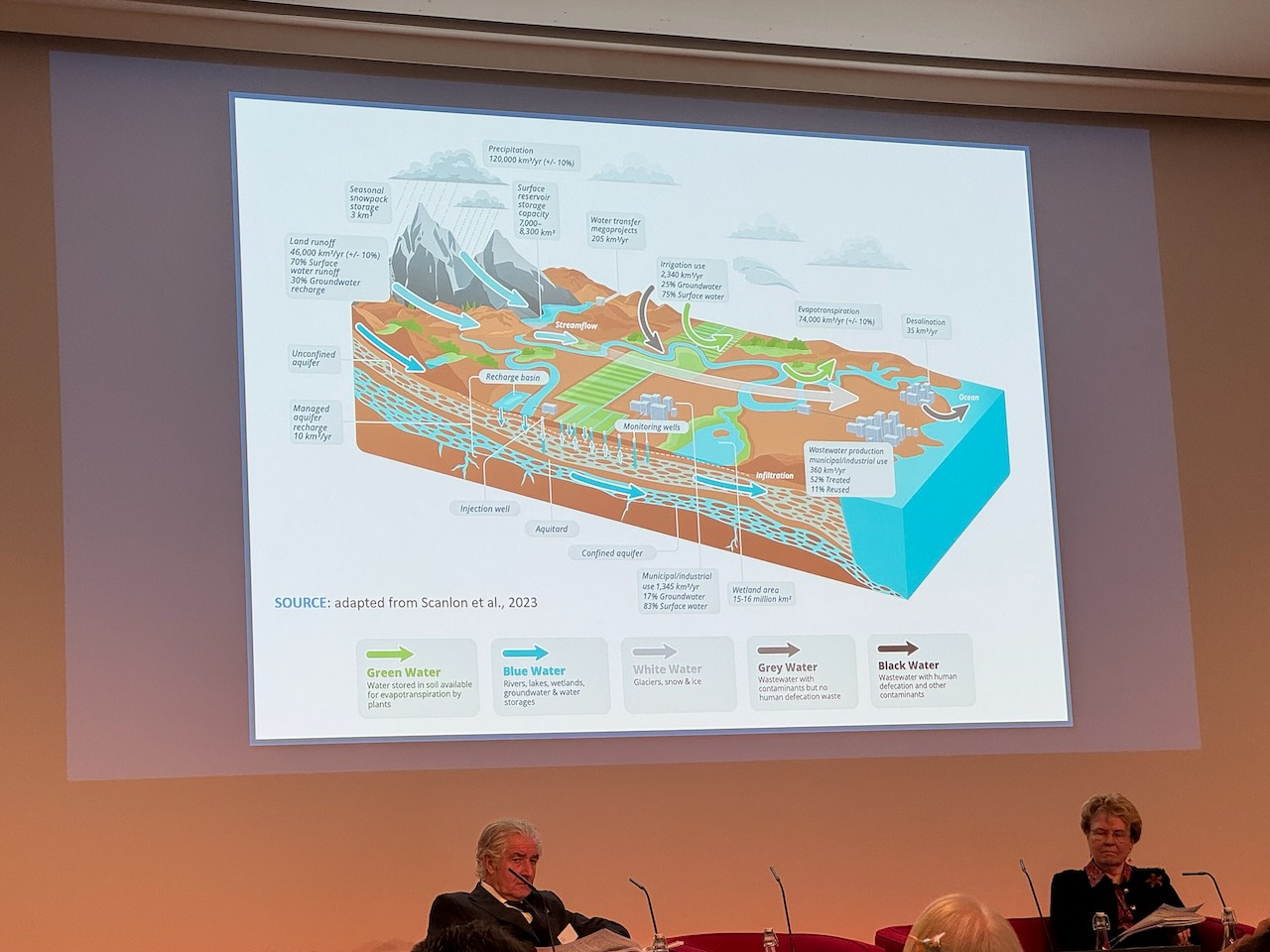

Only 1% of the total water supply is freshwater, and its appropriation among human activities is quite unalanced. We have green water to blue water to white water to grey water to black water. We have messed up the blue and black water management. We are producing 360 billions of cubic metres of waste water a year and only 3% is recycled. A significant percentage of the world population (2 billion people) are dependent on black water, and a lot only have access to grey or black water.

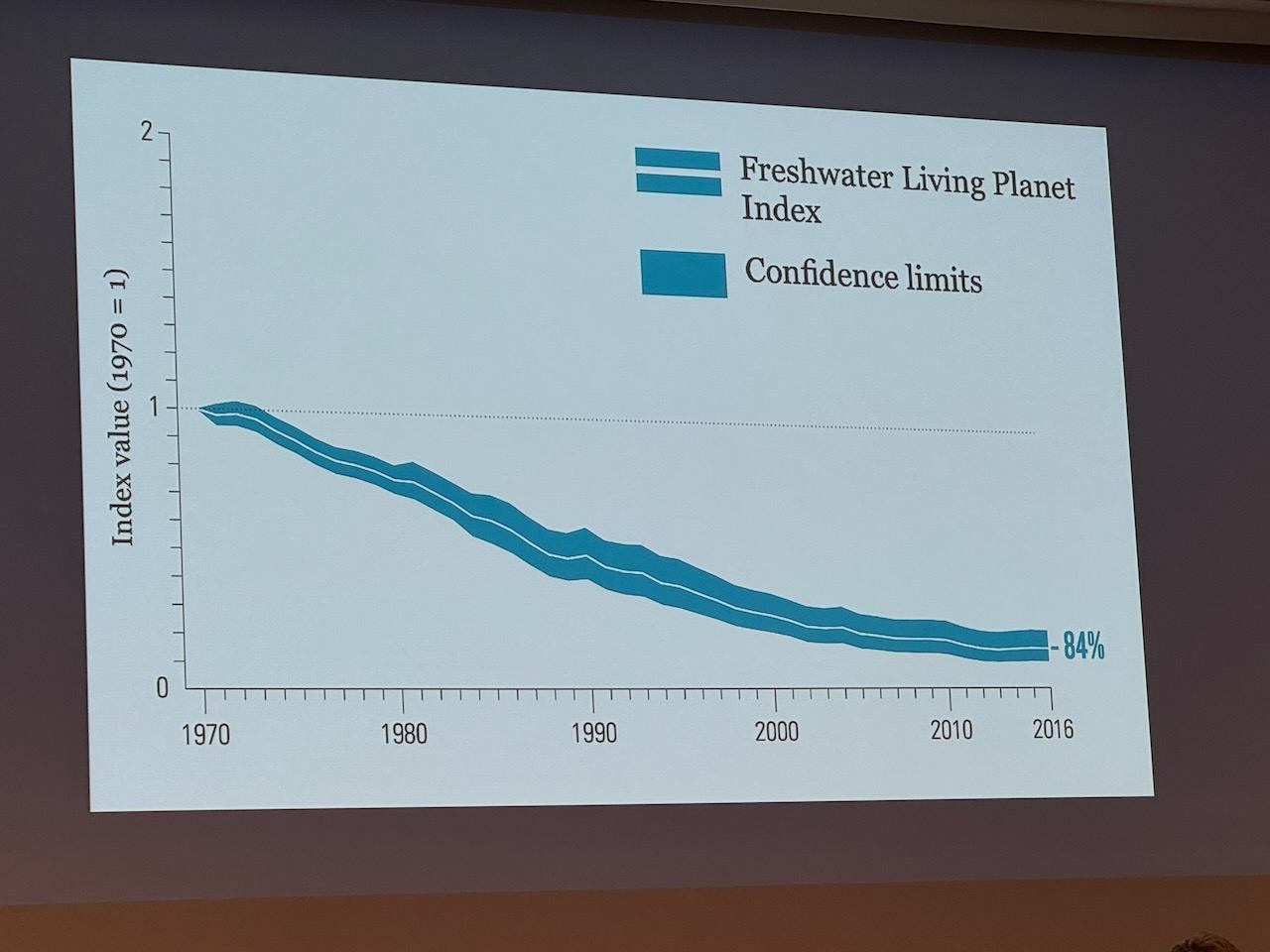

We need to treat management of surface and groundwater systems holistically. The freshwater living planet index is dropping precipitously: some causes are flow reduction, introduction of invasive species and nitrogen/acidification peaks in the 1970s/80s/90s which all causes major changes in freshwater biodiversity. We also introduced laws on long range transport regulation about acidification. In 1991 we had the EU urban wastewater directive and in 2000 the EU water framework directive, but none of this seems to have made much of a difference (see graph above).

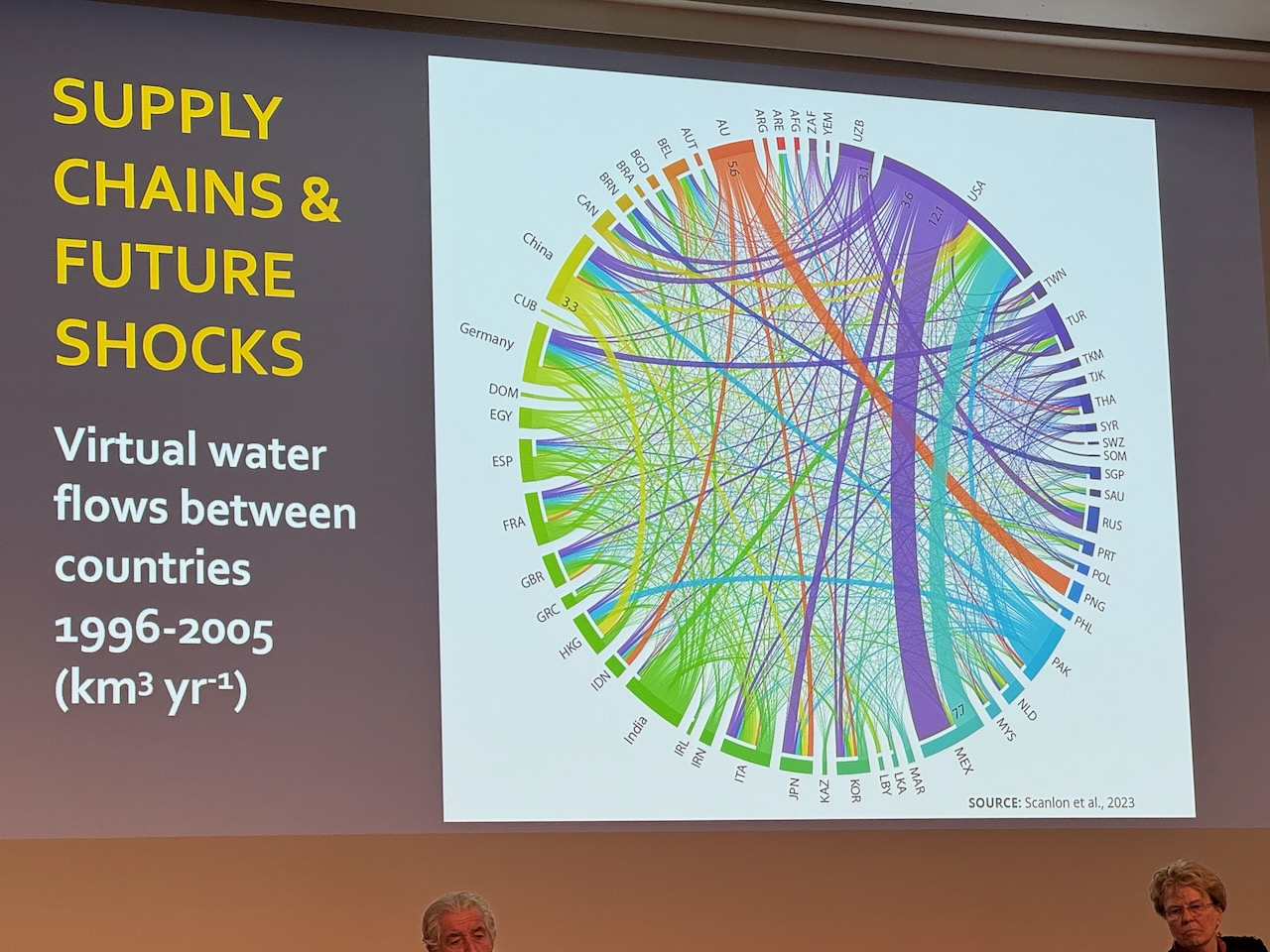

Are we looking a tipping point in terms of waste water systems? We dont have clear metrics about freshwater biodiversity, and without the metrics we dont have a way of valuing them as part of commercial systems. We have new emerging pollutants (microplastics etc) which we have to deal with multi-sectoral changes to make a difference, which is lacking despite the legislation in place. However, the growth in urbanisation (56% of UK population lives in cities, increasing to 70% by 2050) which makes a huge difference to where waste comes from. When we move food around the word, there is a water cost which is passed onto other countries. (Note: see also our preprint on Food impacts on species extinction risks can vary by three orders of magnitude)

When we move to decarbonisation, the last 20% of action (the really difficult bit) is related to land use in particular. But if we join up the practises around good water use and decarbonisation then we have a bunch of innovative interventions, for example natural flood management. There are also cobenefits around infrastructure and there is a real challenge with our UK underinvestment. The last report in 2022 there are some excellent propositions for how to deal with water and atmospheric pollution and biodiversity. We need to act on this report, but progress is slow: e.g. Thames Water is a long way away from actioning this.

In the 1980s, ADAS was the wing of farming and food ministry worked on how to recycle waste better. Metals were the big problem back then, but now there are loads of extra contaminants such as plastics and forever chemicals, We must move towards reusing waste we produce towards reusable end products for farming and dramatically drop our water use.

2.3 Tipping points and biosphere stewardship (Professor Carl Folke)

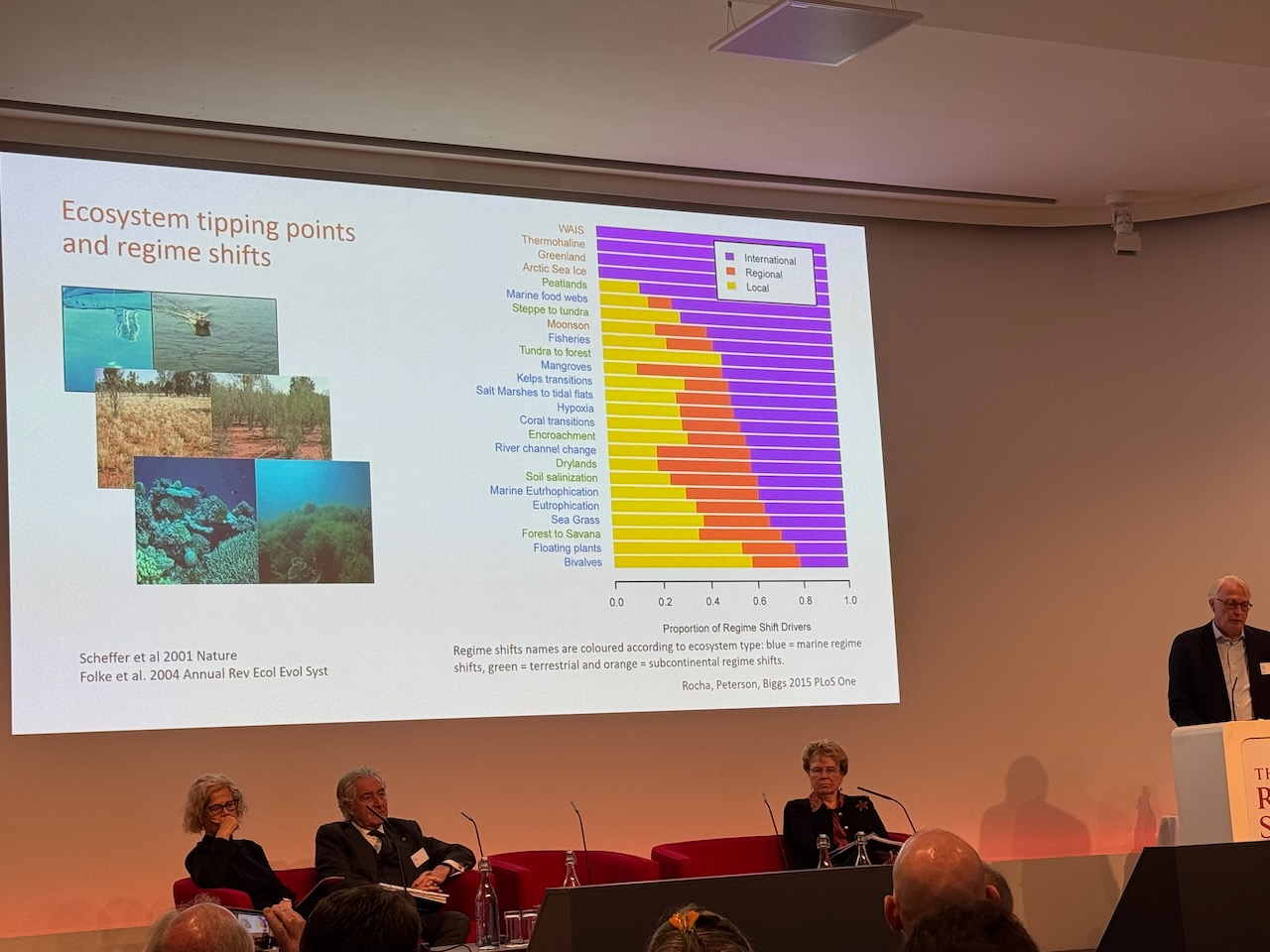

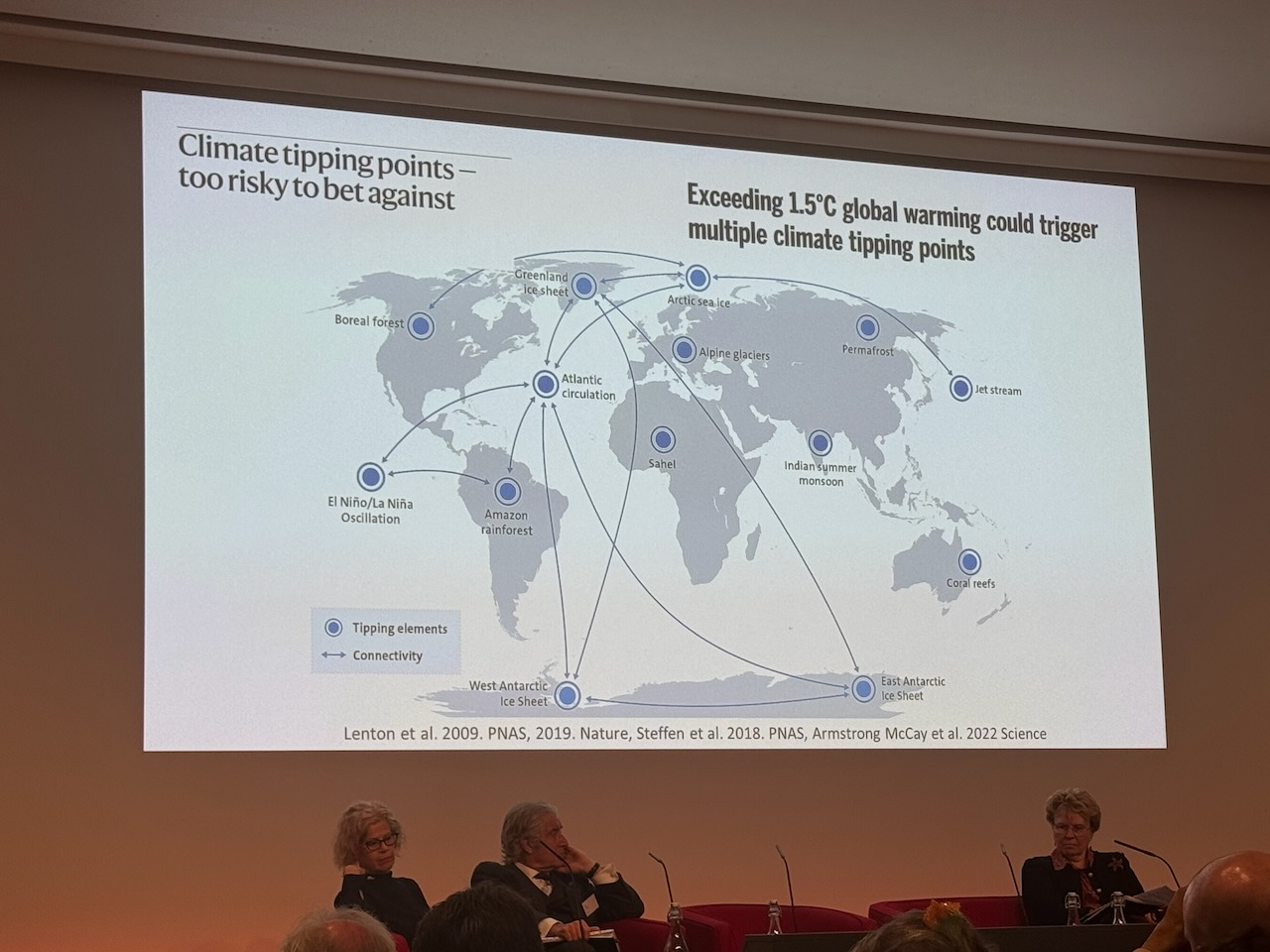

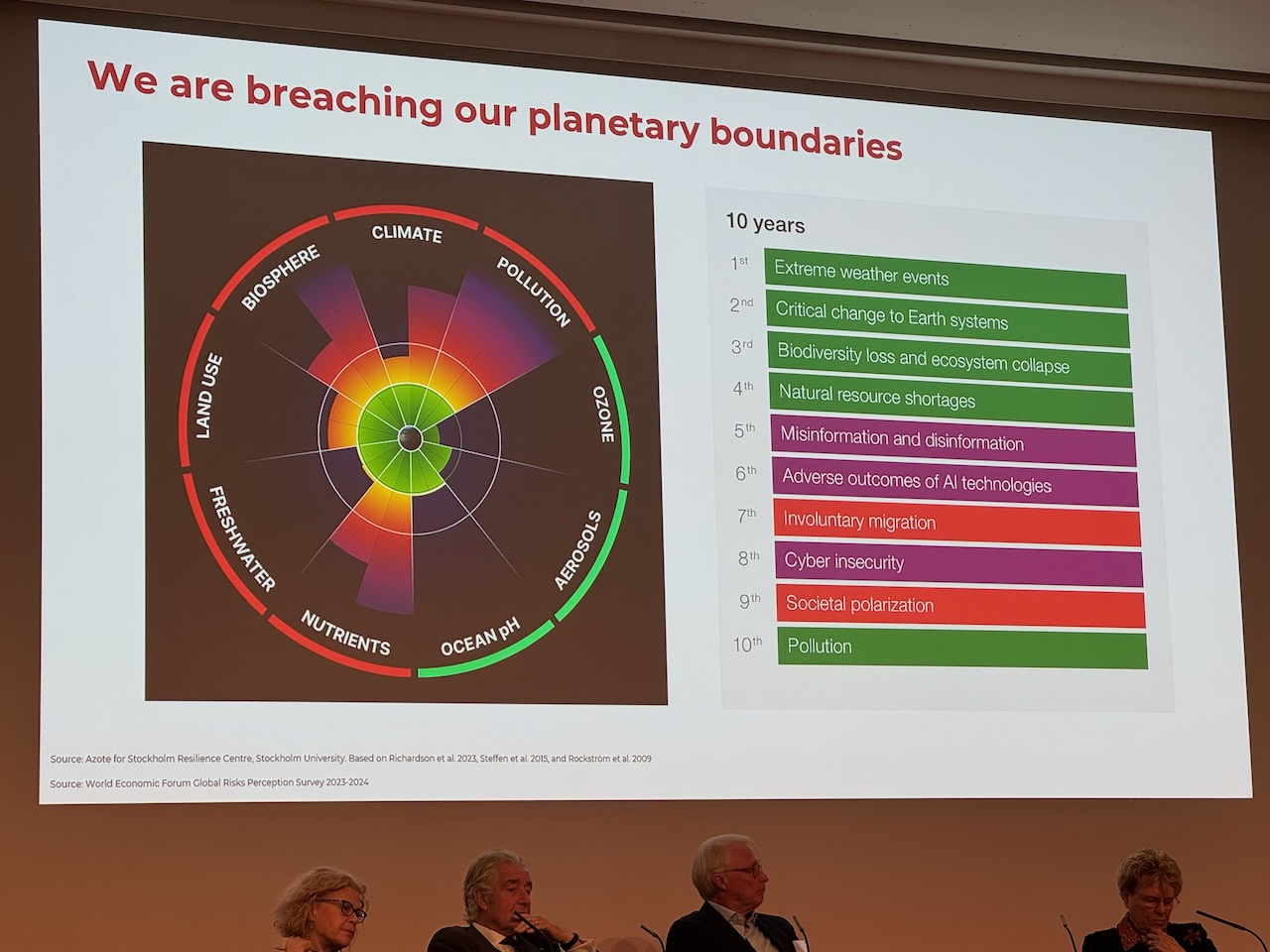

We have polycrises with climate change, biosphere pressure, intertwined systems, interacting shocks, and many tipping points. Tipping points are a shock that can move a system from a local maxima into a new stable state, but also the gradual loss resilience can cause a system to shift suddenly. There are a number of drives that cause these tipping points, and they are not just a random aside: they should be a key part of any investment strategy.

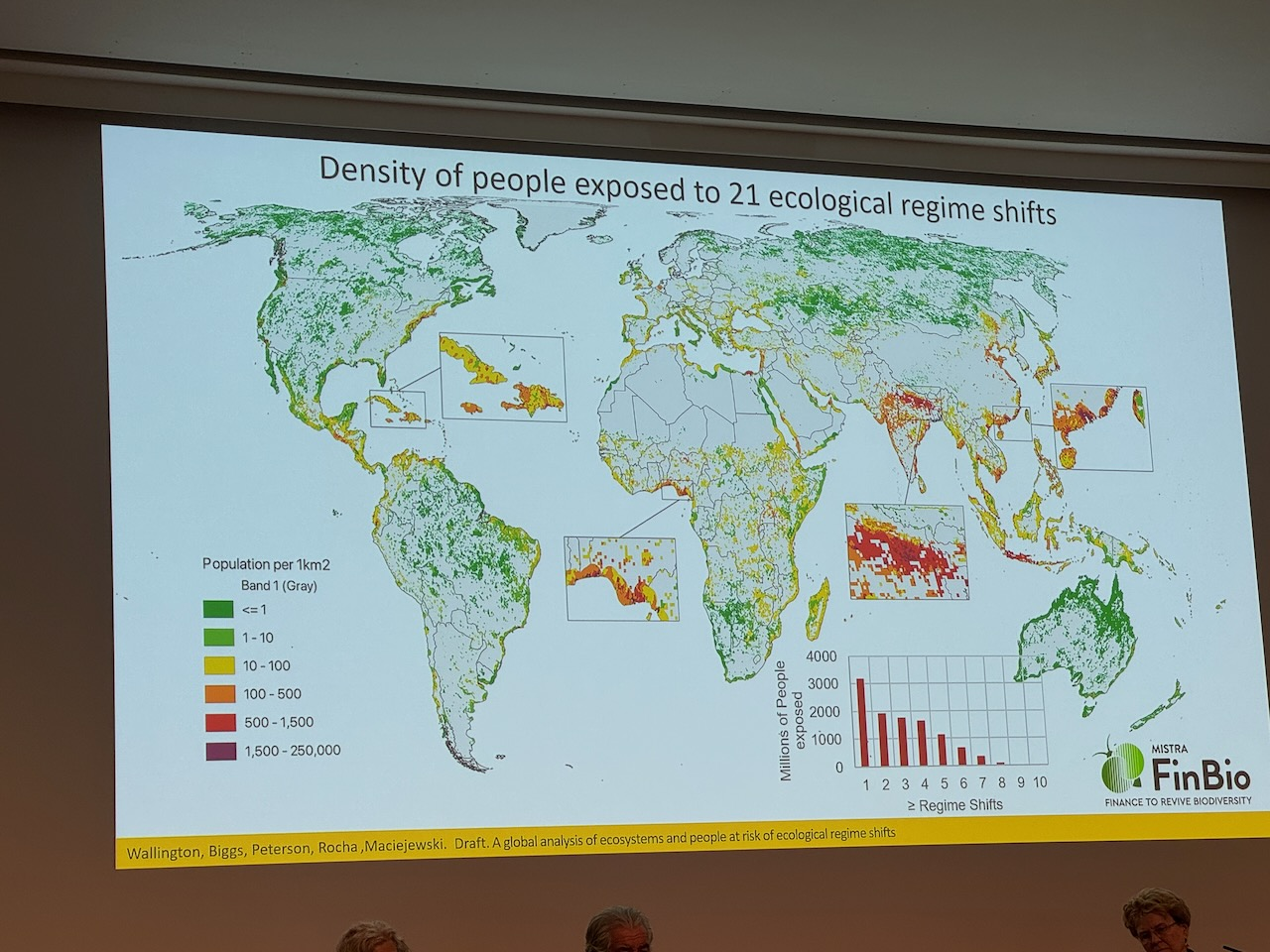

A lot of people live in areas that are at risk of ecological tipping points, and the map seems very correlated to the earlier water change map shown by Louise! 56% of human CO2e have been taken up by the biosphere so far (1430 GtCO2 from 1850-2019) which has been happening for "free" thanks to nature, and this might come to an abrupt end soon which is a big source of worry in the scientific community.

The connectivity of various tipping points is becoming clearer. There are just a few major actors that shape some of these (such as the Amazon rainforest) and they are often quite far away geographically by virtual of their influence over markets.

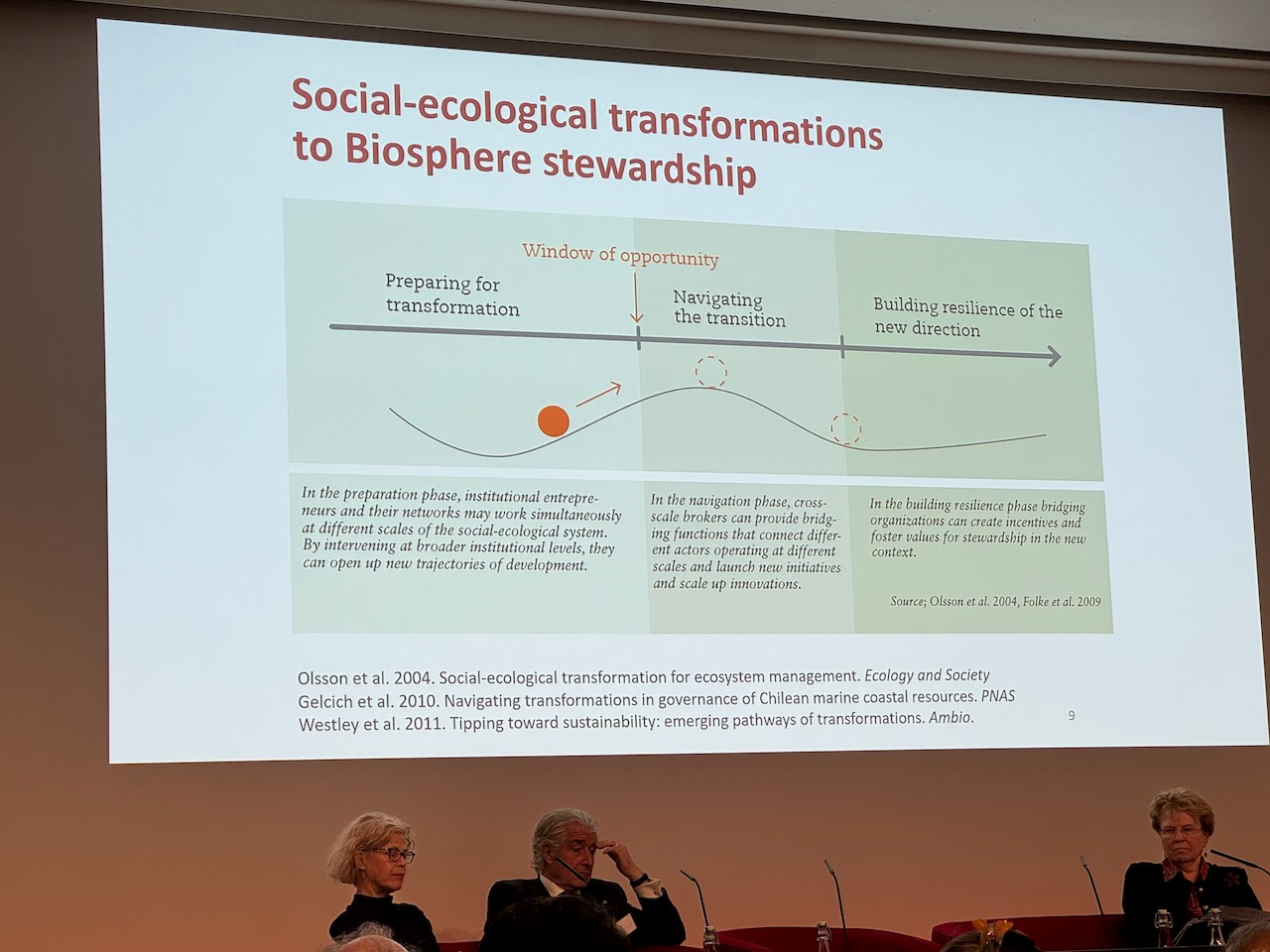

The current idea is that social tipping ("social norms as solutions") is the way to alter our value systems. See "Operationalising positive tipping points towards global sustainability" by Tim Lenton et al. (Note: Simon Sharpe also authored this, see our CSaP reading group on his excellent "Five Times Faster" book.)

So we need to prepare for tranformation, navigate the sudden transition and then build resilience in the new norm after the tipping point. But our window of opportinty is happening right now so action must happen urgently or we miss the window and enter the tipping point unprepared. So "corporate biosphere stewardship" is a new business logic with the purpose of shepherding and safeguarding the resilience of the biosphere for human well-being, and fostering the sustainability of a rapidly changing planet. Rather than viewing nature as a compliance question, we should view it as humanity's greatest business opportunnity! For example, Seafood Business for Ocean Stewardship ([seabos.org](Seafood Business for Ocean Stweardship)) is codifying this approach for marine foodstocks. There is an increasing focus on how to report this stuff. There are three good books to read more on this:

- "Nature's Frontiers", 2023 from the World Bank group.

- "Economy and Finance for a Just Future on a Thriving Planet", 2022 from the SRC.

- "The Green Scorpion", the macro-criticality of nature for finance.

2.4 Ecosystem services and physical risk (Paul Polman KBE)

Paul Polman is the former CEO of Unilever. He started by noting that we have to make sure that we dont just spend our time talking to each other, but we have to get the message out in the form of action to the wider world! When they developed the SDGs, Ban Ki Moon requested Paul to represent the private sector. He was described as "the problem walking into the room" when the politicans first met him, but luckily they ended up in a happier place! We must find a balance into a sustainable economy into the future. Most businesses, although they dont behave entirely sustainabiltly now, they do understand the need for a planet. When he ran Unilever for a decade, they encoutered hundreds of millions of dollars worth of nature-related interruptions tot heir business.

4 billion people in the world depend on natural medicine, and nature governs huge amounts of the human ecosystem. Nature supports peace and national security - many of the world geopolitical events train back to inequality in access to natural resources and this is the foundation for many economics. The WEF report recently calculated thaat $44tn of the world economy depends on nature -- but this is a huge understatement given that our entire life depends on it! Changes in one ecosystem affects others, and so our conversation must address the interrelationship of all this that makes it so complex.

We must not see ourselves at the top of the pyramid -- biomimicry and geoengineering is an arrogant approach as our survival relies on cooperation with the biosphere -- when we destroy nature we destroy ourselves. (paraphrased quote) "Man is the most insane species - he worships an invisible god and destroys the visible nature, not realising that the invisible god he worships is the visible nature he destroys" (original: Hubert Reeves). Extinctions are 10-100x the average of the previous centuries.

Food and land use is about 30% of our global emissions, and yet we have the audacity to keep our famers in poverty. Every $1 invested in changing nature and regenerative farming approaches give us $16 return. The food companies are really exposed if they don't act, much as we criticiise fossil fuel companies right now.

We are making withdrawals much faster than we are depositing in the bank of planetary boundaries, and there are millions of people losing their lives and billions being displaced because of these choices. The Carribean has lowered its tourism by a significant percentage due to beach erosion. The Amazon this year has had unprecedented wildfires (around the size of Italy) as an example. We name our tropical storms (we name them as if they are our friends); would it be different if we named them Exxon Chevron etc? We must absolutely link the commercial sector to nature as companies like Unilever must become border-positive and nature positive as they are hugely global.

Leadership is increasingly centred in europe with many business regulations that are nature positive. There is a bunch of business interaction happening, but the estimation is that loss of biodiversity has cost us over $10tn. In agriculture we are destroying $12tn of value, but if we turn that around its a $4tn opportunity. This just doesn't make business sense to not act. Covid showed us that infinite growth on a finite planet is unsustainable.

What can business do next then?

- Invest in nature. It drives innovation and nature has probably been the best R&D lab (1/3rd of medicines come directly from nature)

- Water utility improvement. If the 500 largest cities looked into restoring local forests and water tables, it would make a huge difference in quality of life.

- A mindset change for business. See his book on the topic. The only way to think in business to be successful now is to think regeneratively and restoratively -- every action needs to contribute to restoration and not cause to us to fail slightly more slowly.

Priorities for business action:

- Repair and restore nature. e.g. 30x30 the global biodiversity framework

- Account for the value of nature, the point of this event. less than 5% of companies today account for nature, and this needs to vastly increase.

- Form partnerships for advocacy and change. most of the big issues cannot be tackled by one company; even at Unilever Paul could only solve about 20% of the problem with one of the biggest companies in the world. So for global change (like "planetary guardians" launched at the UN last week) is another example of partnership.

- Align financial flows using the political moves around GBF and the Paris agreement. We need to put money behind this.

Nature needs business, and nature needs business, and the time to act is now!

3 Discussion

Partial notes from the audience Q&A follow.

Q: To what extent have we made progress in the transition towards a nature positive future -- is the awakening fast enough?

Tony: what we have discussed here is not very well known in the majority of the world's population. Most people get in their car and go to work, and their food is processed and disconnected from nature. So the insight that most people have into their dependencies on nature isnt very well known. David Attenborough has made it clear that if we take steps towards repairing the natural world then people will need to be exposed to nature so that they understand what they're trying to save. This was disconnected in the beginning of the industrial revolution, and we need to urgently reconnect it, or people will simply not appreciate what we're about to lose.

Louise: is quite optimistic because the younger generation is very engaged in this, and we need to ensure they have the levers for action. It's the older generations challenge to bring the right levers to them.

Paul: the science is still evolving at a fast pace, and will continue to, and if we dont convert it to fast practical steps we'll be trouble. Everything starts and ends with educaiton, but we are also out of time. The urgency isnt well understood -- a survey of 4000 people about this skewed to about 30% of people where they left a company because it wasnt aligned with their values. 60% were considering leaving but didnt. We must get businesses to move out of the current gridlock where multilateral institutions cannot change easily, and we must cooperate across boundaries. The EU has a nature restoration law which wouldnt have happened without businesses getting involved to push it over the line for example -- without that it wouldnt have moved. And tipping points mean that only 4-5% change is required to get us to a new stable state, so this is both an opportunity and a risk. The biggest risk right now is the US election, as its a global vote but decided by a tiny minority.

Q: What examples have you seen about nature flows in the real world?

Paul: the economic forces must be made to work; people arent skeptical but the economic realities must work. But there are pressures; the average tenure of a CEO has dropped to 4-5 years and so their actions are aligned with reelection cycles just like poliitics! So we have to make capital and money flow work much more transparently. With a relatively small investment, we can get to 50% regenerative agriculture; this is happening in the USA (thanks to IRA). Many of the major food companies (from Pepsi to Unilever) are committed to $15bn towards soil health and regenerative agriculture. And there is nothing better than healthy soil towards preserving yields in the face of climate change. The average age of farmers is ~50 now and so they only have 10 seasons left before they retire, so they need to be paid to shift proactively for ecosystem services. It needs a proper farmer rewards to do the shift quickly and hedge the risk. Luckily, the speed of nature restoration is faster than we predicted.

Carl: it has become a strategic issues in companies, as opposed to a greenwashing protection. They run an executive course for companies and they are factoring in risks proactively now in a way they didnt before. They are demanding satellite data and other risk management data products to quantify the uncertainties in nature. Earth SYstem Indicators is their system to combine multoiple planetary boundaries into one actionable indicator. It is a bit like an avalanche now where the reaction is awakening, but we are probably in a tipping point right now so we must act in the right direction.

Jane: social systems are highly non linear and also characterised by social system tipping points. Water seems to be an obvious one that underpins the operation of many companies.

Louise: Universities and research must turn into businesses (of innovation). One thing we failed to do is to find the problems but dont find the solutions, and research must come up with solutions. "Ecologists turn over stones looking for problems". We must take a position on coming up with solutions and communicating them clearly, and the only way to do this is to work together across disciplines. We are looking to social scientists to combine civic change with environmental scientists to propose interventions.

Jane: there has been a huge transformation in the US towards finding solutions, and that means partnering with government agencies and NGOs in a way we haven't seen before. (Note: this describes the Cambridge Conservation Initiative model perfectly!).

Tony: even when the solutions exist, a number of entities want to keep the status quo: e.g. Exxon and Shell spent more than two decades pretending it wasnt a problem to protect their interests, and they're not alone. And so we have to establish a social tipping point (just 3-4%) was just the idea of Exctinction Rebellion to overload the court system and get to the point where we could shift the discussion, But it didnt work, so what will work? We need to try, try and try again on this. Otherwise we're rather just talking to ourselves.

Q: Water related financial risks: TCFD galvanised focus on climate, speciifcally carbon, and one of the barriers is this focus on regulations that focus on the cause (carbon) but not the impacts. We mainly feel these impacts through the water cycle, so how can we make the focus on the phsyical risks of climate change being on the impacts and not the cause?

Louise: we need a systems approach to this; tipping points sort of get there, but how do we get the evidence to get over the top?

Q: Why is it that the business and finance community isn't moving faster? The suspicion is that not all businesses are part of the solution, and do we need to be clearer on that? If we combine some of the social aspects and linking of people to nature, does that supply chain need to be shorter?

Paul: we are slightly bending the curve linearly, but the gap is getting bigger exponentially. If we dont solve the problems for the world, we can be great as a company but it doesnt save the planet for the next generation. Business alone cannot do it, but what we can do is to make it more transparent. The more transparent we are the more we change behaviours and social norms. Companies using AI across supply chains are doing surprisingly well at bringing this transparency around. In every transition in the history of mankind, there will be people resisting change, but now the noise globally is becoming louder is a big deal and is a sign that the process is unstoppable and has begun. The noise will only increase in the next five years. In the food chain there are herbicide, pesticide producers that are doing really well on food speculation, but at the expense of many lives. We need a leader to change them, and if they dont change they will obsolete their business models.

Q: What is the single most important action businesses can take today to address the crisis? Q: Why not spin this around to look at this at a very local level (e.g. flooding for business crisis)? Q: Unless we can localise analysis with improved precision, can we improve decision making?

Tony: Localisation of issues is critical. The founding slogan of Friends of the Earth was to "think globally act lcoally" which was a very good slogan. Natural England is working with local authorities on spatial planning exercises on where the good remaining nature exists and where it might usefully be repaired (cleaning up peatlands etc). The targeting of the resources like this might help us bend the curve. This must be linked with our need to build 100k new houses and balance natural and business.

Paul: COP30 is likely to involve businesses heavily (COP29 is a writeoff due to location). But businesses are getting behind it all as countries cant implement their policies without business help. A large percentage of indigenous populations are planetary guardians and so we must support their efforts to protect existing natural capital against tipping points. Science without impact is useless when we have a crisis at this level.

4 Day 1 Reflections by Sir Partha Dasgupta

Ecosystems are capital assets; we now use the term natural capital to include the biosphere in the full stock. This raises the question of asset management, and the questions discussed today represent shortcomings in asset management.

With natural capital, property rights are hard to enforce -- nature is always on the move and "mobile" and the commodity changes when it moves. This leads to an underpricing of many forms of natural capital (not all, but many) which leads to the overuse of it, which in turns leads to deterioration of the asset, which implies a runaway tipping point of decline. This all leads to a circular decline in the value of natural capital; if there is a heightened risk of an asset collapsing, the accounting value is naturally reduced. So this is a vicious cycle at work that leads to the inevitable decline.

Global GDP has increased hugely as opposed to natural capital, which increases the pressure to overspend on natural capital. What are the arbitrage conditions (e.g. risk adjusted rate of return) on the portfolio assets that comprise natural assets? Because of imperfect pricing, there is a big misalignment of any portfolios. For example, the Ganges is the most polluted river in the world and under the Ganges action plan to remedy this there was a social cost benefit analysis -- there was a 15% rate of return calculated. The rate of return on government bonds was roughly 5%. There was a gap of 10% between these two assets, and so if the structure was efficiently organised then the Ganges value as a stock should be decreasing by 10%. But this is perverse since the reverse should hold since the river quality has been decreasing not increasing!

So from the firm's point of view we are looking at their balance sheets (from the natural capital POV). But GDP was not constructed for this purpose -- instead it was constructed in the post war period to calculate progress towards getting out of economic depression resulting from lack of economic activity. But somehow after WWII it became a long-term goal but it has no social benefit justification. GDP is a flow and so not a future predictor like stocks. You can have GDP growth and the national package of accounts, but it just won't take natural capital into account. There is a gap between portfolio management and GDP therefore.

But countries are moving towards wealth accounting bit by bit, including for natural capital aspects of wealth. Most of the attention has been towards human capital, including the attention of investors. This now needs to shift quickly towards natural capital. There have been studies attempting to assess the market demand for natural capital. Think of the biosphere as a massive fishery -- the natural analogy is how much we take out of it, and what the regeneration rate is. The question is what the overreach is and there are projects working on this. We need to take the outputs of these projects and treat them as underestimates due to the huge extinction pressure on organisms.

Even if firms are competing in the market, they still need to cooperate on the underlying natural capital accounting to avoid a "market crash". In academia, there is both cooperation and competition. There is a race for paper publication, but also a huge amount of sharing towards global scientific co-creation. There is a good deal that companies could learn from this to cooperate and communicate towards natural capital accounting. More on day 2 tomorrow about how we can get there!

5 Day 2: Metrics and Actions

Kat Bruce (founder of NatureMetrics) opened the session by noting just how quickly the biodiversity space is moving, and how encouraging it is to see so many businesses engaging with environmental scientists.

5.1 Metrics for business use (Prof Neil Burgess)

Is going to cover terrestrial metrics only. There are several sorts of metrics we could measure:

- pressures on biodiversity

- steady state metrics for biodiversity

- measuring benefits from biodiversity

- response metrics on the effectiveness of biodiversity interventions

We do need to understand biodiversity risk in regional detail so that businesses can use this to influence their actions. There is also the need for clear target setting to know how much opportunity cost to "spend" on biodiversity vs other actions.

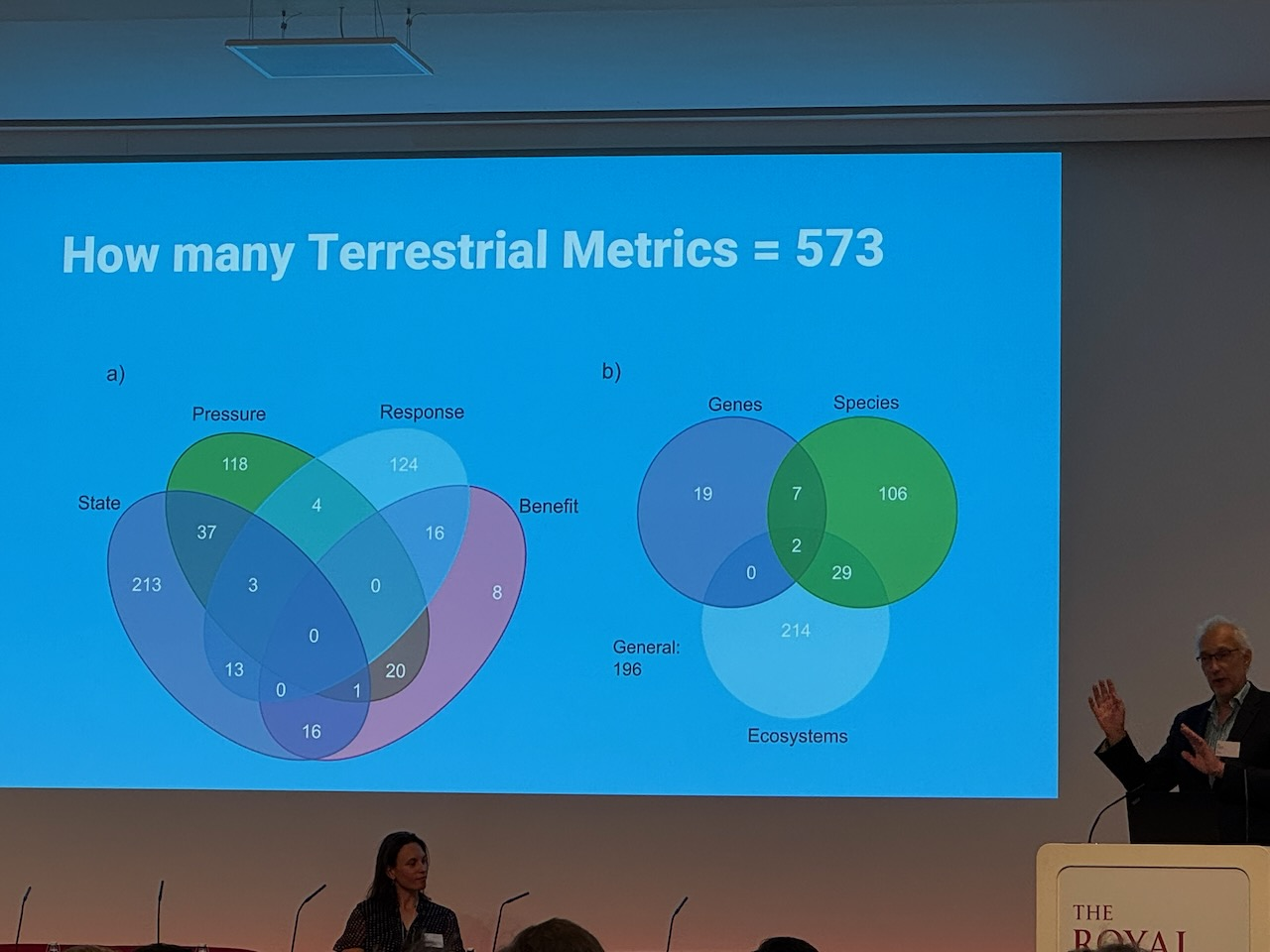

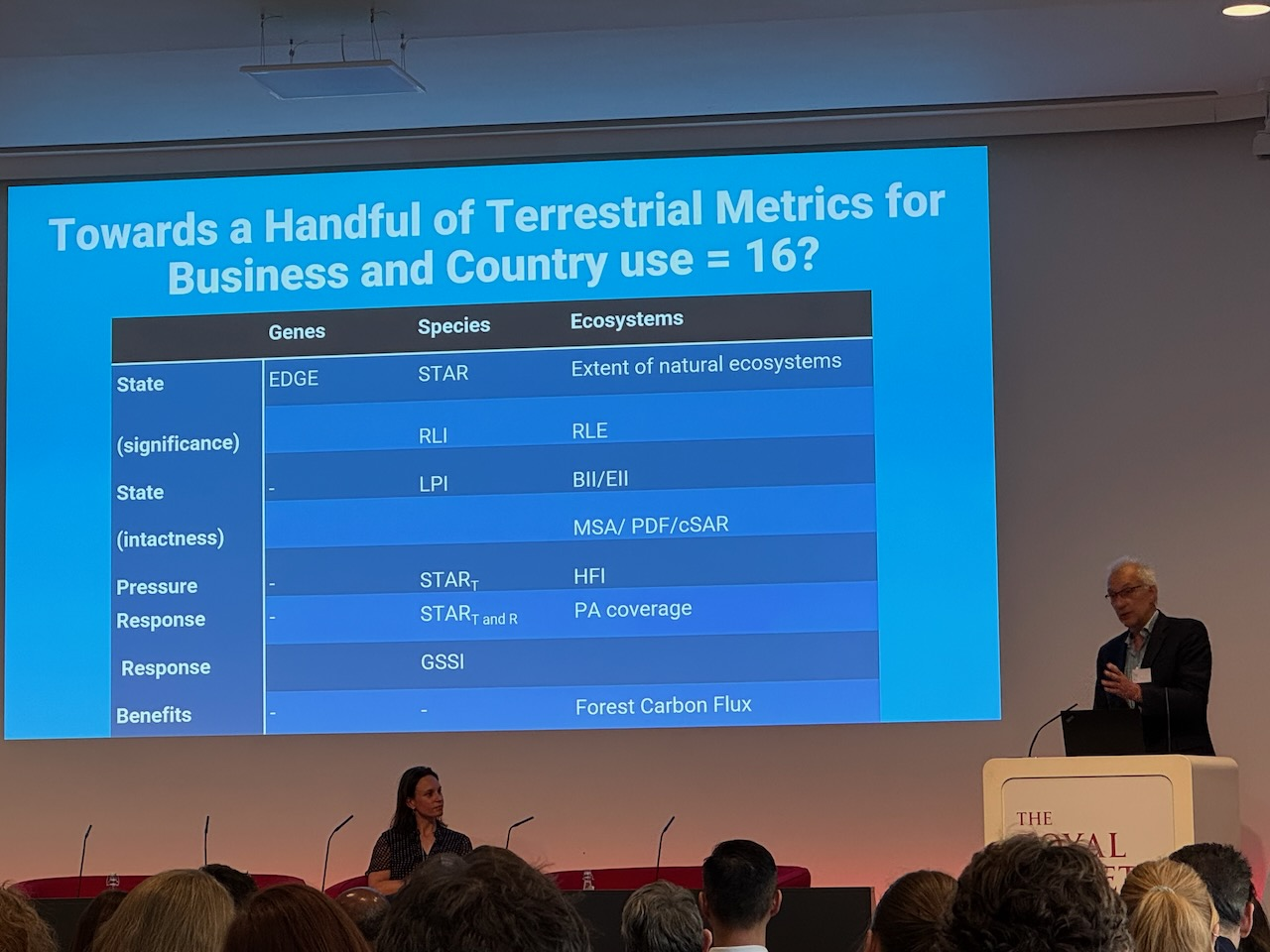

UNEP-WCMC have a huge database about all the various metrics (~573!) that cover biodiversity. If you even add other things like marine, the number breaks 600 (see picture). There are around 23 useful ones for business use; there are few in this list that check benefits to people or discuss genetic changes, but there are lots of on diversity, habitat area and so on. (Neil noted that our LIFE: A metric for mapping the impact of land-cover change on global extinctions paper isnt listed as its not published yet till the end of the year, but it will be!)

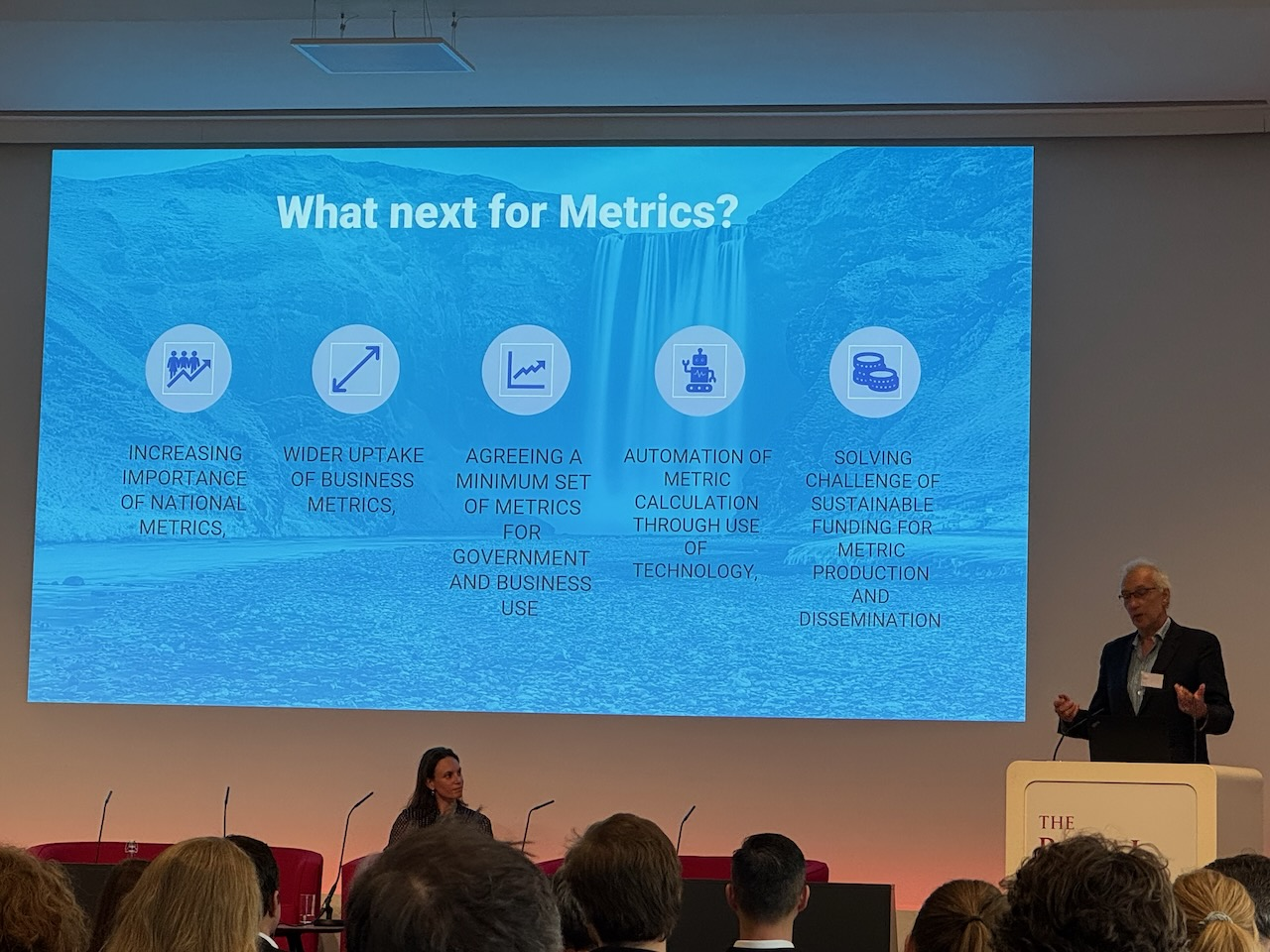

There is quite a lot of work needed to make the metrics usable, and a pipeline. He also noted the importance of incremental pipelines and mentioned the incremental pipelines that Michael Dales and Patrick Ferris are working on for these. And this is something I'd like to advance with Planetary Computing...

The main tool that pulls this together is IBAT which is a paid-for model to support its continued developed. There is also the free ENCORE nature platform. For supply chains, there is also tools to help check the country to country. There is a big emphasis on the need for open sharing between platforms as well due to the sheer complexity of biodiversity worldwide, which is a key thing to keep the platforms sustainable both financially and equitably.

5.2 Data availability and use (Prof Andy Purvis)

Andy's career as a scientist started 35 years, and he is now at the Natural History Museum as a senior researcher. The mission there is not just to track the decline of the planet, but also to advocate towards a healthier nature positive society as well.

We have a million or so species of animal and plants threatened by species extinction. Our job as scientists is to come up with defensible statistics, but they also don't convince anyone. So stories about individual species (like the white rhino) are vital to build public awareness about the real impact.

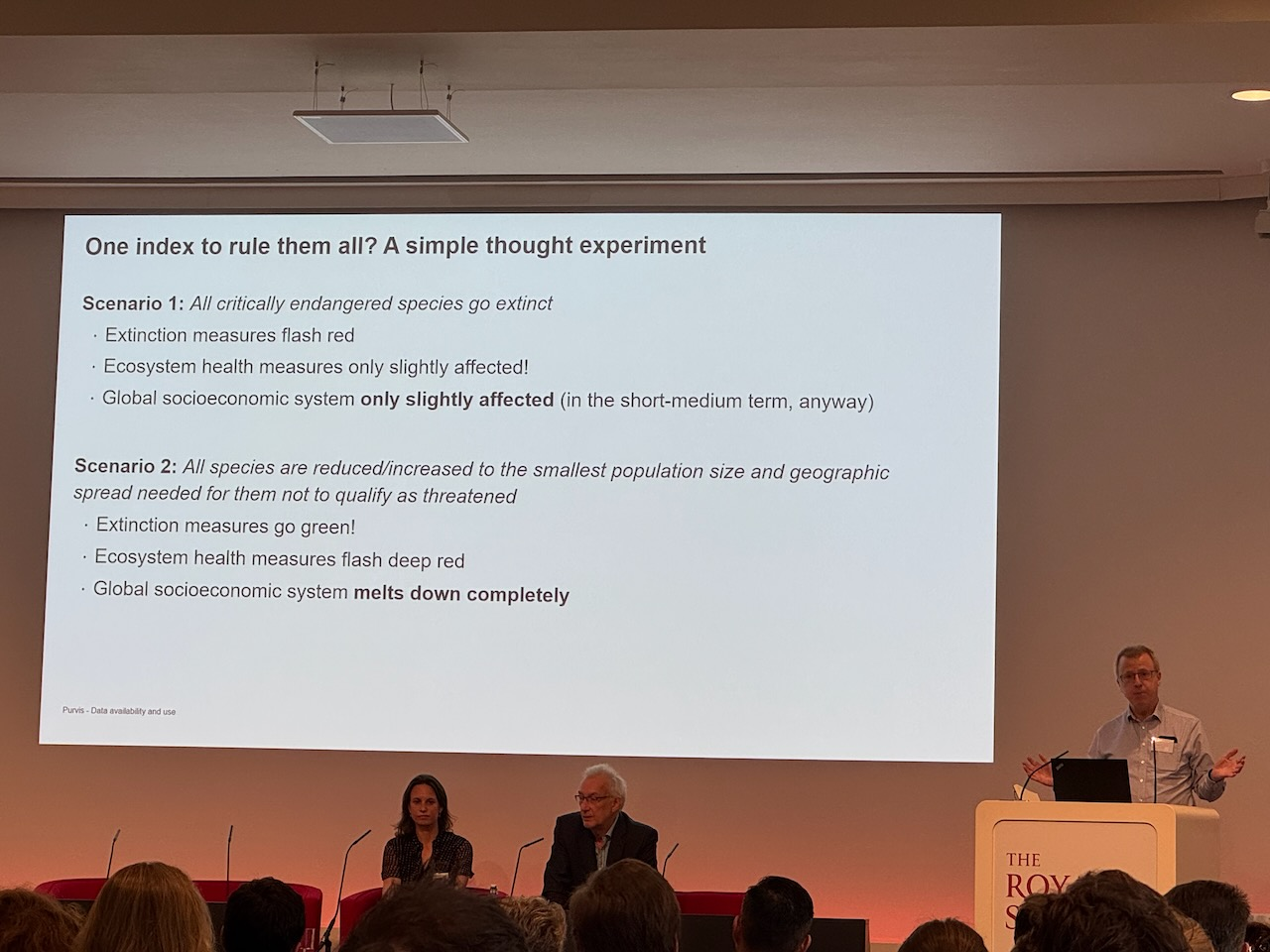

Is there one index to rule them all? Andy is against that idea of a single metric to describe the world's biodiversity. Any indicator combining some of the metrics has an "exchange rate" between extinctions and human wellbeing. In other words, it creates an "extinction market".

Decision grade data are derived very carefully from very biased raw data. And the data collection requires a huge amount of expertise, and is painstaking to conduct. This has to be funded, and not even the collection of the raw data is very well funded right now. To illustrate the data bias, there are a huge amount of birds...and mallards...in there, which is clearly not representative of global species spread.

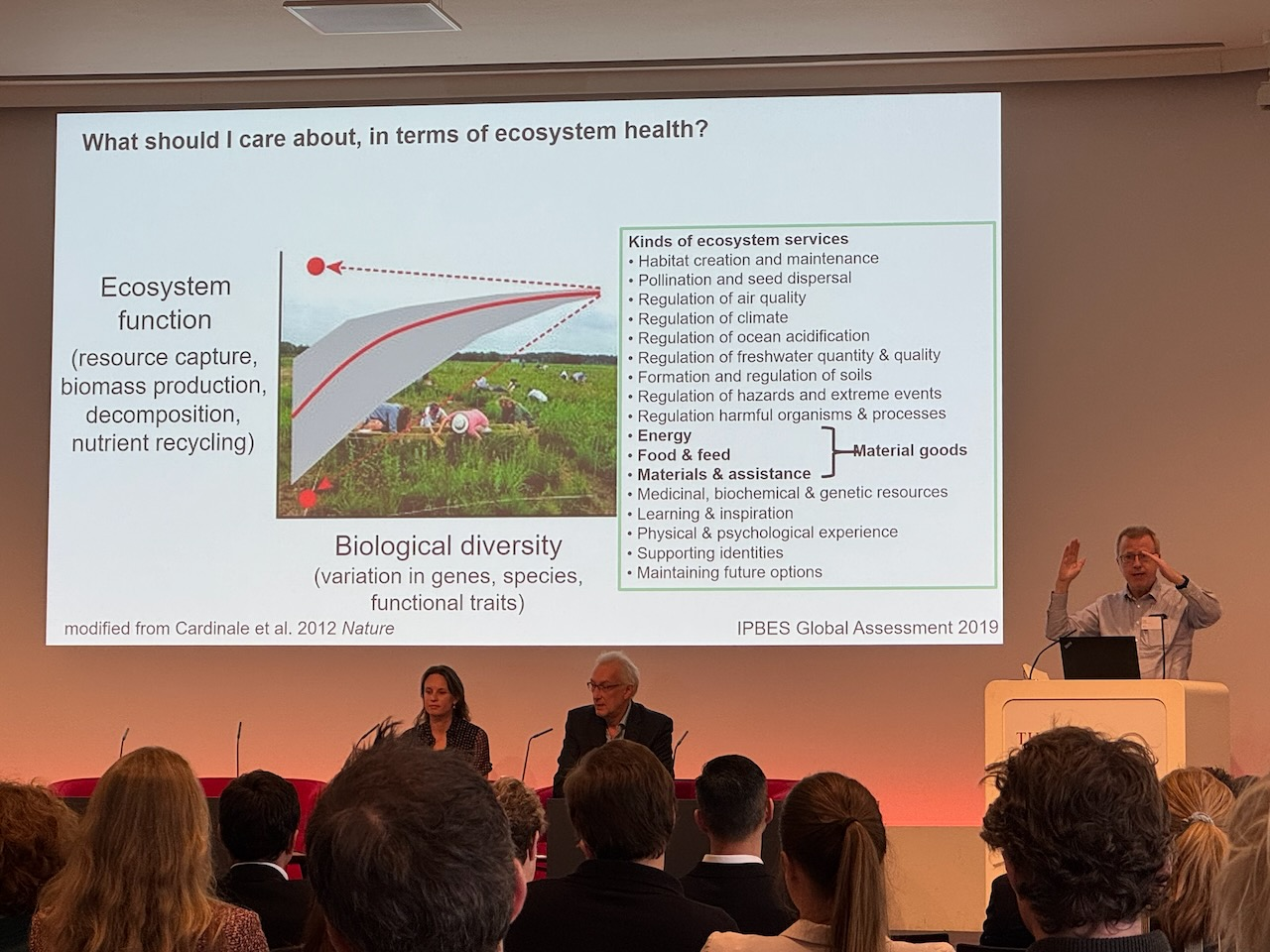

We can plot ecosystem function (resource capture, biomass production, decomposition and nutrient recycling) on the axis of biological diversity (variation in genes and species and functional traits). Across this, there is a huge spectrum of ecosystem services that this supports, of which a few are really useful to humans. And the BII index is a statistical model relating nature to human pressures that produces both high resolution temporal and spatial models.

What should we do in terms of ecosystem health?

- Deintensify activities in unhealthy systems where people depend on local ecosystem services

- Divest from businesses that are poor stewards of ecosystem health

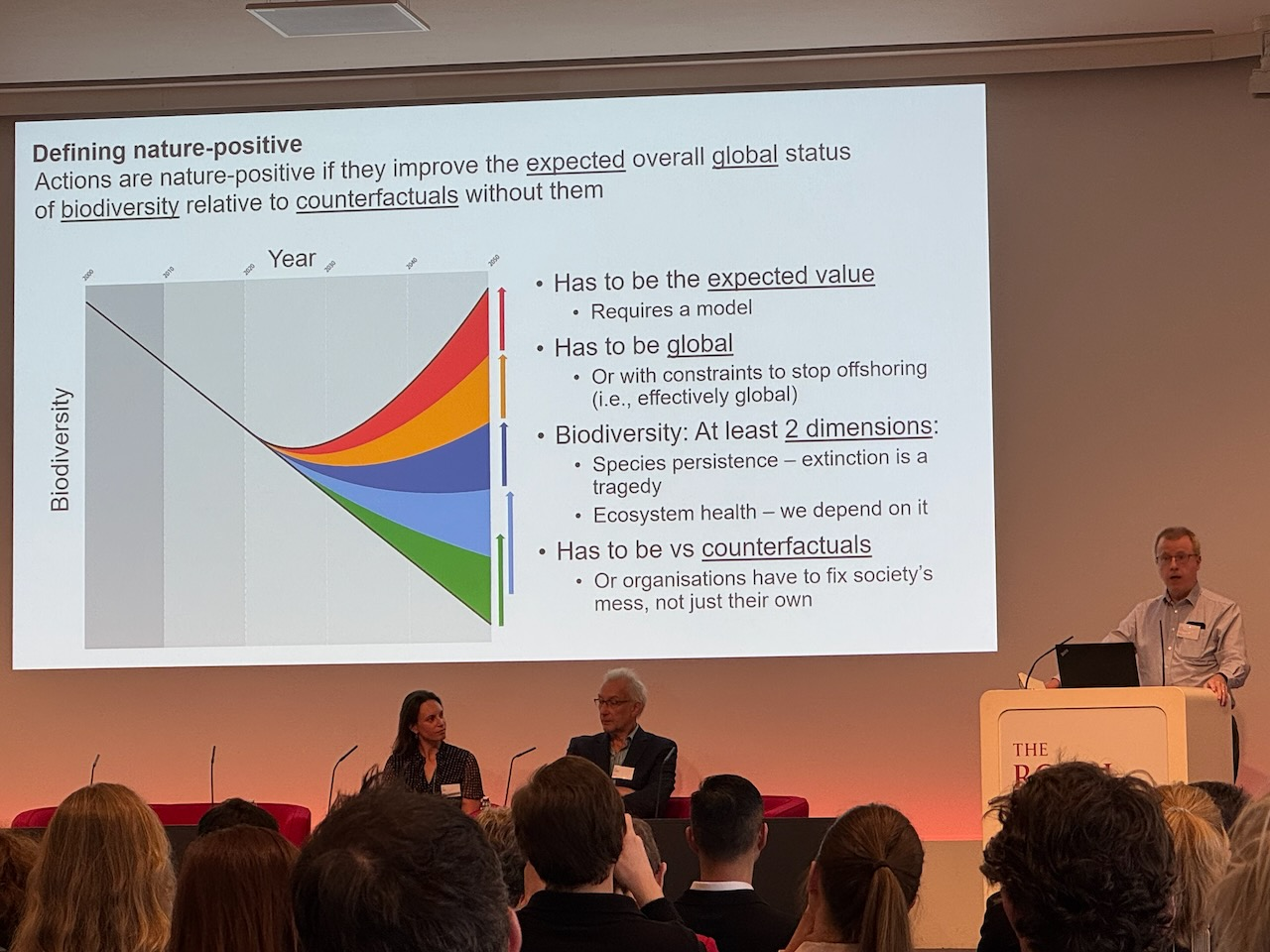

- Invest in actions that are "nature positive", which is an action that improves the expected global status of biodiversity relative to counterfactuals.

It requires a model, has to be global, and measure both species persistence and ecosystem health. It has to be vs counterfactuals otherwise the cost is too high for any individual organisation vs society taking action collectively.

We need to combine models with monitoring to give us a "sat nav" for nature. There is a need to monitor drivers as well biodiversity, which relies on data being available to improve the models. And if the platforms are open then this is possible. There are platforms in the form of Geo BON, IBAT, BII ha a data license with Bloomberg, and some TNFD tools.

Take home messages:

- Use data whose methodologies are transparent

- Remember the pitfall of hybrid indicators or indices

- Reduce extinctions and mitigate existing activities in important areas and dont do new human activities there

- Divest from poor stewards and invest in nature positive actions

- Monitor closely to verify gains and contribute to data repositories

- Accept that decision grade data does cost money and needs funding!

5.3 Q&A

- Is the restoration of an ecosystem the reverse of destruction curve?

- Is there consensus about BII outside of the NHM team?

- Are we moving towards biodiversity standardisation?

- How can we make these metrics to be more understandable to businesses?

Andy: if we go back to a system with the original biodiversity, but the actions to get it there don't have an immediate effect (there is a timelag). There's no standardisation effort yet across many metrics, but we are moving towards ensembles of models with alternative sets of inputs for the environmental rasters in order to normalise the uncertainty in both the environmental and geographic space.

Neil: UNEP-WCMC uses BII a lot! In terms of metrics, a species and ecosystem metric and something on genes would cover the three dimensions of biodiversity, but others also need to be factored in. There is an effort to use AI/geospatial to get higher resolution landuse data (is this a forest?) and also probabilistic SDMs, but no standardisation.

Kat: being able to reverse degradation is a secret weapon for nature as it has an incredible ability to bounce back if pressures are reduced due to its innate resilience. The aspect of the data we often forget about is its ability to tell these stories and drive uptake, and this is powerful.

- What are the greenwashing risks of nature-positive counterfactuals?

- When we boil down the metrics that are ready for both country and business use, what are the qualities that make a metric useful? There were only 16 or so outside of ~600!

Neil: There are criteria (peer reviewed, published, etc) with lots of feedback from the co-authors of the paper (to appear later this year). There are strongly held opinions in the biodiversity metric space. But it's actually not a huge and manageable list of metrics.

Andy: trying to avoid false claims of nature positive requires verification. We're going to get better at this by estimating the net gain and how certain its positive. The models will improve when there is a connecting pipeline to monitoring data and needs verification. So any payment for nature-positive claims needs to be staged and ex-ante.

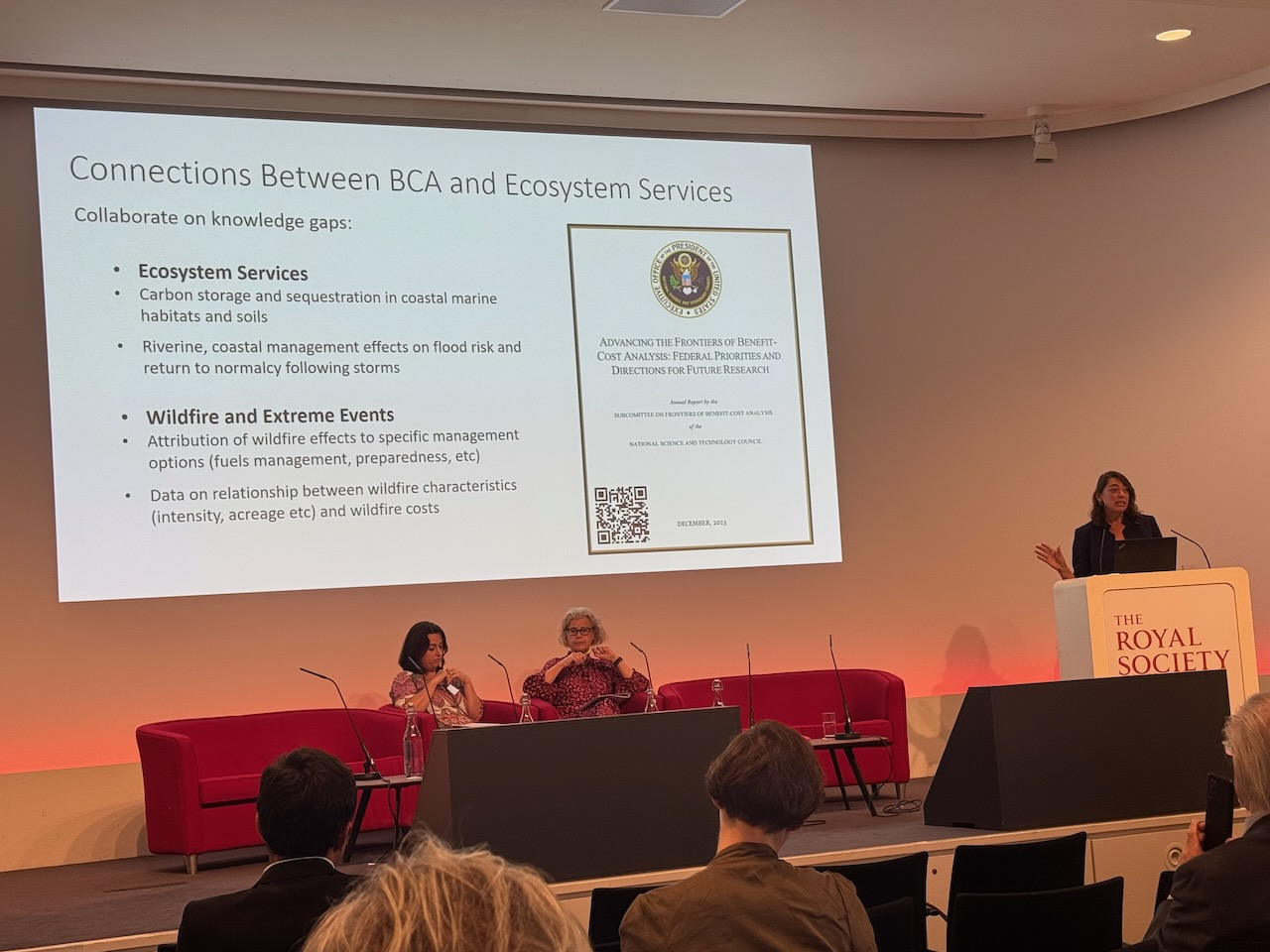

6 Other talks

I failed to capture notes for the middle sessions as I was engrossed in conversations, but here's a gallery of some of the fantastic speakers! They're on the livestream video if you want to catch the details.

Partha's Day 2 roundup

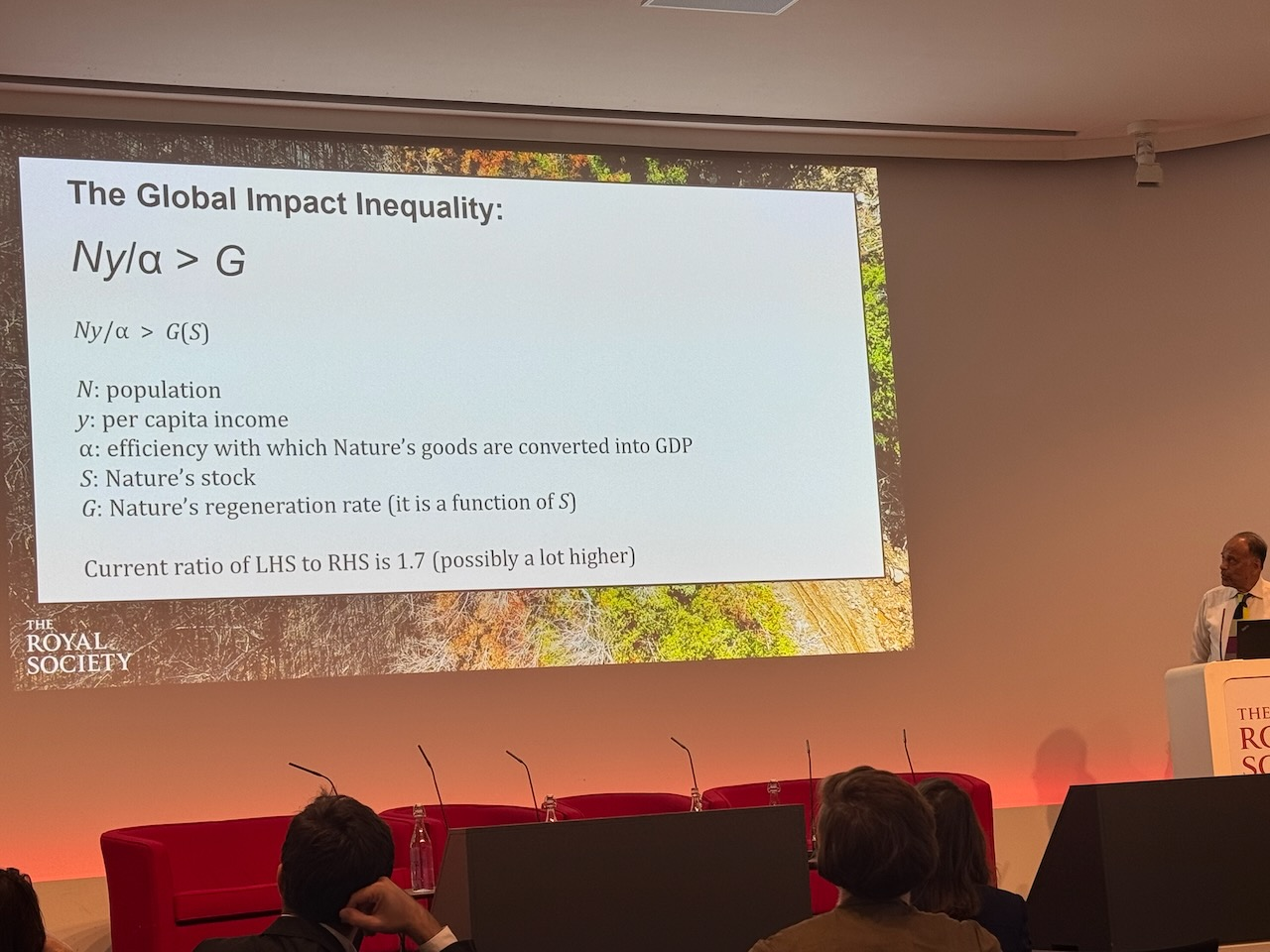

See the equation below. The right hand side is G (nature's regeneration rates) and is a function of the state of the biosphere (the S).

The left hand side is the human demand (human activity) which is a per-capita adjusted population and the efficiency of provisioning goods (recall what those are from the start of day 1 notes).

Most of the discussion in these two days have been on the right hand side. A huge amount of the literature is on the alpha, and how technological progress can raise alpha (e.g. via cleaner energy) and help rebalance the inequality. How fast can alpha change, as the faster it grows, the faster GDP and natural capital grows.

How might we advocate for change? The total we pay ourselves is 2-3% of global GDP for subsidising our assault on nature. Removing those subsidies is the equivalent of raising alpha. Adam Smith's classic book in the 18th century was the "Wealth of Nations" and not the "GDP of Nations". For us, wealth includes natural capital. Even as early as 60 years ago, human capital didn't appear in the economic literature. Most national accountants include statements about the increase in human capital, and for our purposes we must include natural capital in the notion of wealth. We must shift accounting away from GDP into calculations of stock and inequalities, as shown in the equation.

What the discussions missed didn't discuss invasive species and the "transfer of natural capital" through the fact that goods and services are traded. This is represented in the capital N in the equation. So that's future work!

7 Follow more

This concludes my rapid note taking. Do join the livestream and follow for the remaining day and a half if you have a spare moment!

Edit: upon being prodded by Alec Christie, I've uploaded a NotebookLM generated podcast summary of the morning. It's surprisingly entertaining, but I'm sure I'm going to regret this for some reason...