Our commentary on nature-based credits has been published in Nature Sustainability, lead expertly by my colleagues Thomas Swinfield and Sophus zu Ermgassen.

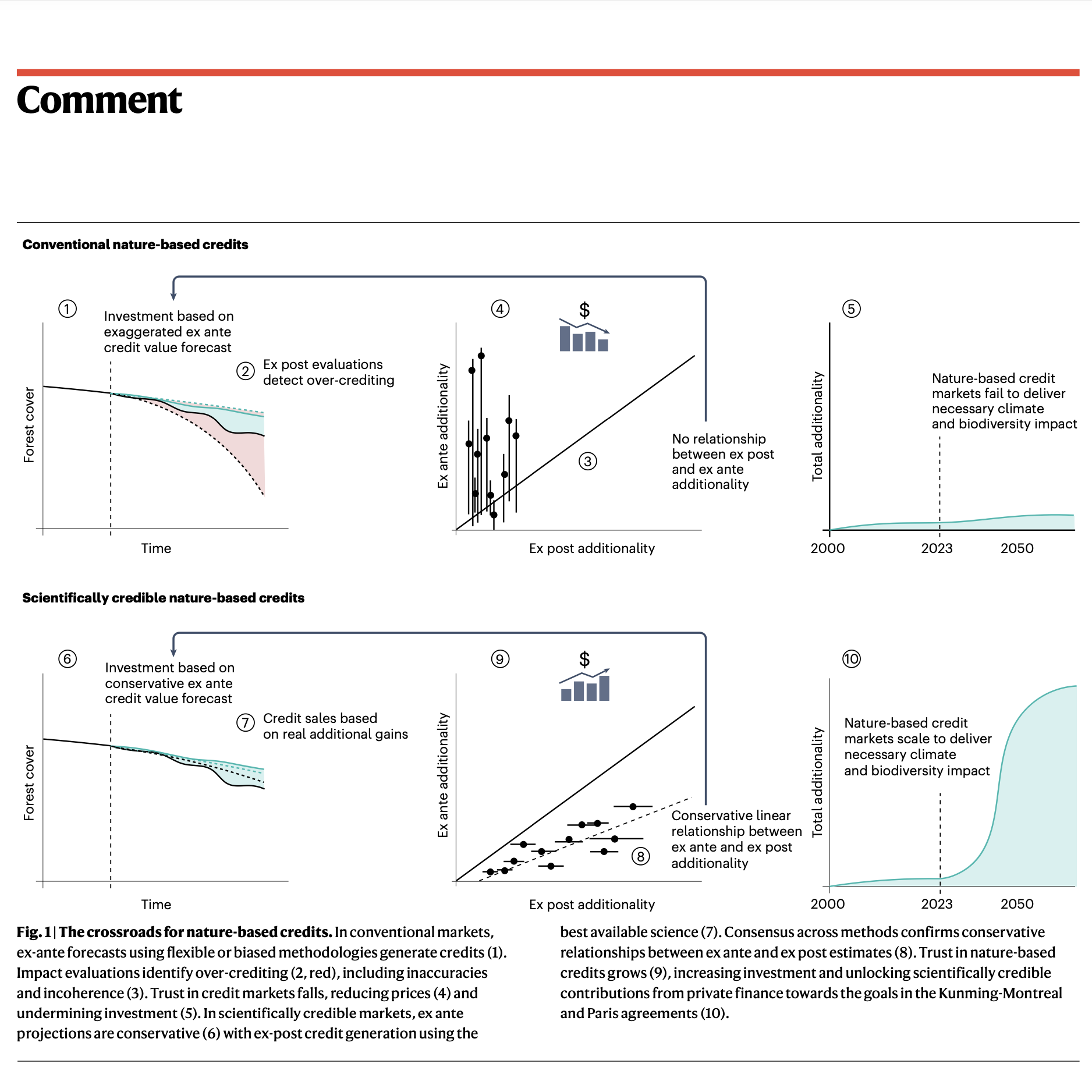

In our view the carbon credits markets are vitally important for forest conservation, but the key is to only transact these credits after they have been proven to be demonstrably additional using robust statistical techniques, so that we know before a sale that each credit represents real gains that would not otherwise have occurred without the carbon finance.

A more scientific approach that supports transparent, third-party validation could absolutely transform these markets. And given the rapid rate of tropical forest loss, such upscaling of credibility is vitally necessary to raise investor confidence in protecting nature, since we can now be confident that every "credit" sold is resulting in real climate benefit. There are real questions remaining about this reform, of course.

0.1 Where does early project finance come from?

Since projects can no longer sell ex-ante credits (i.e. future credits which may not be real), then we need to come up with financing models that embrace the upfront risk. This already happens in other areas such as oil and gas; as Siddarth Shrikanth notes:

<..>speculative efforts like mining or oil exploration, we’ve still managed to build large industries out of uncertain (but potentially very valuable) payoffs. The challenge here will be to figure out which archetype different projects fall into, and create enough trust that the output will be real and valuable enough to someone to justify the up front investments<..> -- Siddarth Shrikanth via LinkedIn

Lead author Sophus zu Ermgassen comments as well that:

Society has made huge policy commitments to upscale carbon & biodiversity offsetting. But, carbon credit markets have suffered serious hits to their credibility & nascent biodiversity markets risk inheriting shortcomings. Impact evaluations have shown that these markets have systematically underdelivered additionality. -- Sophus zu Ermgassen via LinkedIn

We've been working on this aspect in 4C, since ex-ante predictions of outcomes are necessary for project developers to be able to forecast financing. See the paper "Mitigating risk of credit reversal in nature-based climate solutions by optimally anticipating carbon release" for our latest work on that, lead by E.-Ping Rau and Srinivasan Keshav.

Sophus zu Ermgassen also gave a fantastic talk at the CCI ont his topic a few months ago that is a must watch for anyone working on carbon or biodiversity markets.

0.2 Questions of equity and justice

It's also not enough to "just" show that a given project is additional from a satellite perspective, but also that they do not result in justice and equity concerns for the local populations. Current reporting practices often require only superficial descriptions of how projects approach justice and equity issues, which are challenging to verify and lack consistency and transparency. So our group has also been working on a framework for assessing justice and equity impacts, started by Miranda Lam. I've also been working with Sophie Chapman and Eleanor Toye Scott on the Legal perspectives on integrity issues in forest carbon. Please do get in touch if you have thoughts on this aspect of project development.